How profitable is China Tobacco?

From:

Tech Company Date:05-26 2207 Belong to:Industry Trends

Have you ever thought about a question: With the largest number of smokers in the world, China National Tobacco Corporation sits firmly on the throne of "China's most profitable company" and "the world's largest cigarette manufacturer".

So how much profit does China Tobacco make every year?

Taxation丨China Tobacco

.jpg)

According to public information on China Tobacco's official website, Zhang Jianmin, party secretary and director of the State Tobacco Monopoly Administration, and general manager of China National Tobacco Corporation, announced such a set of data at the 2019 National Tobacco Work Conference:

In 2018, the tobacco industry achieved a total industrial and commercial tax and profit of 1,155.6 billion yuan, an increase of 3.69% year-on-year; a total of 100.08 billion yuan handed over to the state finances, an increase of 3.37% year-on-year; an industrial added value of 787.7 billion yuan, an increase of 4.88% year-on-year; The total income is 55 billion yuan, and the average income from tobacco growing is 54,000 yuan, helping 41,000 poor tobacco farmers to get rid of poverty.

What is the concept that the total amount of industrial and commercial taxes and profits and the amount paid to the state's finances exceed 1 trillion yuan? In 2018, the national tax revenue was 15.64 trillion yuan, and the individual tax paid by the people of the country was only 1.387.2 billion yuan.

The industrial and commercial tax and profit of the tobacco industry across the country has been increasing year by year, from 145 billion yuan in 2002 to 388 billion yuan in 2007, with an average annual growth rate of more than 20% during the five-year period. In 2009, tax and profit exceeded 500 billion yuan for the first time, and since then, it has risen all the way, reaching 800 billion yuan in 2010, successfully surpassing the 1,000 billion mark in 2014, and hitting a record high of 1,155.6 billion in 2018.

What is the concept of 1,155.6 billion?

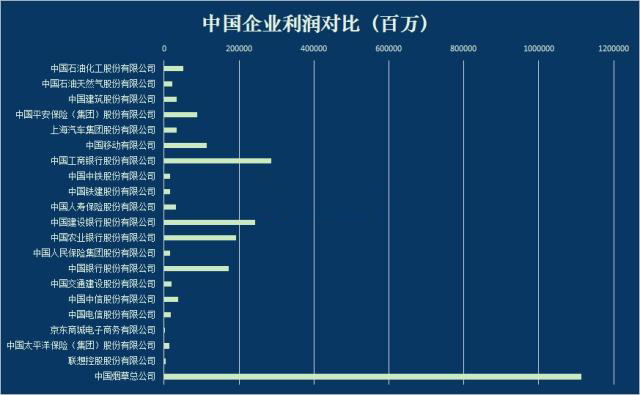

From a horizontal comparison between companies, if you select the latest China's top 500 companies selected by Fortune in July 2017, you will find that these 500 listed companies have annual profits of 3.48 trillion yuan. In 2017, the total industrial and commercial profit and tax of China National Tobacco Corporation was 1.1145 trillion yuan.

The total profit of the top 14 companies on the list in 2017 was 1.15 trillion yuan, slightly exceeding the total industrial and commercial profits and taxes of the China National Tobacco Corporation during the same period.

How does it compare with the "black gold" oil industry? According to data released by the China Petroleum and Chemical Industry Federation, in 2017, the total profit of my country's petroleum and chemical industry was 846.2 billion yuan.

The three Internet giants of BAT that we know well,

The total profit before tax in 2017 was 21.283 billion yuan, 79.611 billion yuan and 88.215 billion yuan.

.jpg)

In 2017, China Tobacco's 11.14.51 billion has already crushed BAT.

With the icon, the huge gap between these three business giants and China Tobacco can be seen more clearly.

.jpg)

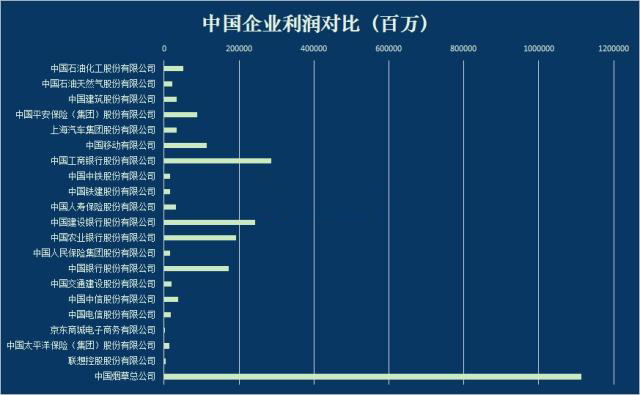

So the top five most profitable A-share companies in 2017: are the profits of the four state-owned big banks and Ping An of China compared with China Tobacco?

.jpg)

China Tobacco takes the lead!

In 2017, the tax profit of China National Tobacco Corporation was three times the total profit of ICBC.

So how did the "tobacco money printing machine" come about?

High market share. The Chinese tobacco industry has been implementing a monopoly system since 1982. In 2016, the China National Tobacco Corporation's share of the domestic tobacco market has reached about 98%.

High taxes. National tobacco tax mainly includes value-added tax and consumption tax.

The tax rates of the two types of taxes are:

1. Value-added tax: According to Article 2 of the "Interim Regulations on Value-added Tax of the People's Republic of China", tobacco belongs to the sale of goods and the value-added tax rate is 17%.

2. Consumption tax: According to the "Notice on Adjusting the Consumption Tax on Cigarettes" of the State Administration of Taxation, the tax rate for all types of tobacco: Class A cigarettes (transfer price of 70 yuan or more per article): tax rate of 56%, plus 0.003 yuan per stick. Collection at the production stage; Class B cigarettes (the transfer price is less than 70 yuan/piece): 36% tax rate, additional 0.003 yuan/stick, collected at the production stage; commercial wholesale: 11% tax rate, additional 0.005 yuan/stick, at wholesale The tax rate for cigars is 36% and the tax rate for shredded tobacco is 30%.

So how much profit does China Tobacco make every year?

Taxation丨China Tobacco

.jpg)

According to public information on China Tobacco's official website, Zhang Jianmin, party secretary and director of the State Tobacco Monopoly Administration, and general manager of China National Tobacco Corporation, announced such a set of data at the 2019 National Tobacco Work Conference:

In 2018, the tobacco industry achieved a total industrial and commercial tax and profit of 1,155.6 billion yuan, an increase of 3.69% year-on-year; a total of 100.08 billion yuan handed over to the state finances, an increase of 3.37% year-on-year; an industrial added value of 787.7 billion yuan, an increase of 4.88% year-on-year; The total income is 55 billion yuan, and the average income from tobacco growing is 54,000 yuan, helping 41,000 poor tobacco farmers to get rid of poverty.

What is the concept that the total amount of industrial and commercial taxes and profits and the amount paid to the state's finances exceed 1 trillion yuan? In 2018, the national tax revenue was 15.64 trillion yuan, and the individual tax paid by the people of the country was only 1.387.2 billion yuan.

The industrial and commercial tax and profit of the tobacco industry across the country has been increasing year by year, from 145 billion yuan in 2002 to 388 billion yuan in 2007, with an average annual growth rate of more than 20% during the five-year period. In 2009, tax and profit exceeded 500 billion yuan for the first time, and since then, it has risen all the way, reaching 800 billion yuan in 2010, successfully surpassing the 1,000 billion mark in 2014, and hitting a record high of 1,155.6 billion in 2018.

What is the concept of 1,155.6 billion?

From a horizontal comparison between companies, if you select the latest China's top 500 companies selected by Fortune in July 2017, you will find that these 500 listed companies have annual profits of 3.48 trillion yuan. In 2017, the total industrial and commercial profit and tax of China National Tobacco Corporation was 1.1145 trillion yuan.

The total profit of the top 14 companies on the list in 2017 was 1.15 trillion yuan, slightly exceeding the total industrial and commercial profits and taxes of the China National Tobacco Corporation during the same period.

How does it compare with the "black gold" oil industry? According to data released by the China Petroleum and Chemical Industry Federation, in 2017, the total profit of my country's petroleum and chemical industry was 846.2 billion yuan.

The three Internet giants of BAT that we know well,

The total profit before tax in 2017 was 21.283 billion yuan, 79.611 billion yuan and 88.215 billion yuan.

.jpg)

In 2017, China Tobacco's 11.14.51 billion has already crushed BAT.

With the icon, the huge gap between these three business giants and China Tobacco can be seen more clearly.

.jpg)

So the top five most profitable A-share companies in 2017: are the profits of the four state-owned big banks and Ping An of China compared with China Tobacco?

.jpg)

China Tobacco takes the lead!

In 2017, the tax profit of China National Tobacco Corporation was three times the total profit of ICBC.

So how did the "tobacco money printing machine" come about?

High market share. The Chinese tobacco industry has been implementing a monopoly system since 1982. In 2016, the China National Tobacco Corporation's share of the domestic tobacco market has reached about 98%.

High taxes. National tobacco tax mainly includes value-added tax and consumption tax.

The tax rates of the two types of taxes are:

1. Value-added tax: According to Article 2 of the "Interim Regulations on Value-added Tax of the People's Republic of China", tobacco belongs to the sale of goods and the value-added tax rate is 17%.

2. Consumption tax: According to the "Notice on Adjusting the Consumption Tax on Cigarettes" of the State Administration of Taxation, the tax rate for all types of tobacco: Class A cigarettes (transfer price of 70 yuan or more per article): tax rate of 56%, plus 0.003 yuan per stick. Collection at the production stage; Class B cigarettes (the transfer price is less than 70 yuan/piece): 36% tax rate, additional 0.003 yuan/stick, collected at the production stage; commercial wholesale: 11% tax rate, additional 0.005 yuan/stick, at wholesale The tax rate for cigars is 36% and the tax rate for shredded tobacco is 30%.